An In-Depth Enduring Markets Review 2022. Is Enduring Markets Legit?

|

Regulation and License |

None |

|

HQ |

London, United Kingdom |

|

The founding year |

2022 |

|

Leverage range |

- |

|

Minimum deposit |

$200 |

|

Platforms |

Web-based trading platform |

|

Tradable Instruments |

Stocks, forex, CFDs, ETFs, crypto, commodities, indices |

|

Demo account |

No |

|

Base Currencies |

EUR, USD |

|

Customer support |

Yes (English) |

|

Active clients |

- |

|

Publicly traded |

No |

|

Crypto |

Yes |

|

Website |

Pros and Cons of Enduring Markets

|

Pros |

Cons |

|

Offers trading signals |

No Islamic and demo accounts |

|

Personalized investment plans |

Lacks free educational content and tools |

|

A wide range of payment options including Bitcoin |

No long history in the online brokerage landscape |

|

Seven types of live accounts |

Unlicensed, unregulated broker |

|

Limited insured trades |

Limited customer service options |

Enduring Markets Overview

Founded in 2022, Enduring Markets is a forex and CFD broker that also offers personalized financial plans to its clients. Traders can access CFDs across the major financial markets: commodities, indices, ETFs, stocks, crypto, and forex.

The broker provides two physical office addresses.

- 160 Victoria Street, London SW1 5LB United Kingdom

- Marina One East Tower, 7 Straits View, Singapore 018936, Singapore

However, Enduring Markets provides its services worldwide. All clients need is to agree to the terms and conditions and be over 18 to register and start trading.

Enduring Markets provides its clients with an easy-to-use trading platform. The trading terminal is accessible via web browsers. Unfortunately, there is no desktop-based terminal or mobile app for on-the-go trading. Something else worth noting is that Enduring Markets is an unregulated broker.

Our expert reviewers have examined the platform exhaustively in this Enduring Markets review. Read on to learn every aspect of trading with the broker to decide if it's the right fit for your trading needs.

Enduring Markets Safety Review

Enduring Markets is an unlicensed and unregulated broker. The broker didn't include licensing information on its website at the time of writing this Enduring Markets review. This means no regulatory body is monitoring the broker and holding it accountable.

The broker also makes no mention of the segregation of clients' and company funds. Separating the funds assures clients that their funds are safe in the unfortunate event that the company goes bankrupt. On the brighter side, existing Enduring Markets clients haven't voiced major concerns about the broker's services yet.

Trading risk disclaimer: CFD trading is highly speculative and risky. Margin trading comes with high risk and is, therefore, not suitable for every investor. Keep in mind that past performance is not an indicator of future outcomes.

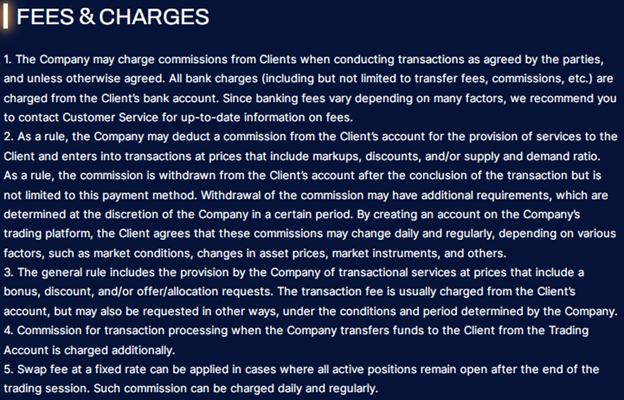

Enduring Markets Fees

The Enduring Markets website and terms and conditions document make no mention of inactivity fees, which is a big plus. There are no monthly fees associated with any of the accounts. On the downside, withdrawals are subject to a fee. Unfortunately, it's difficult to compare the Enduring Markets withdrawal fees to the industry average because the fixed rates are not disclosed.

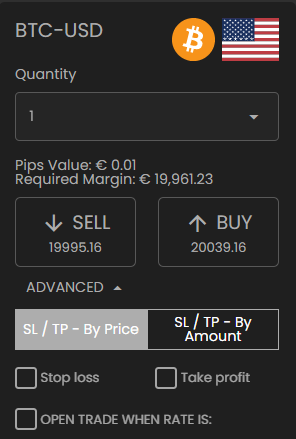

Enduring Markets Spread Overview

Like most brokers, Enduring Markets doesn't publish its average trading fees, including spreads. However, traders can view the spread rates for any asset they want to trade on the broker's web-based terminal. At the time of writing this Enduring Markets review, the following were the spread rates for different products.

|

Assets |

Pips Value (Spread) |

Required Margin |

|

Major currency pair GBP/USD |

€ 0.1 |

€ 1,140 |

|

Commodities, wheat |

€ 0.01 |

€ 841.27 |

|

Stocks, LYFT |

€ 0.01 |

€ 16.99 |

|

Indices, NASDAQ |

€ 0.01 |

€ 11,857.13 |

|

Crypto, BTC/USD |

€ 0.01 |

€ 19,968 |

|

ETFs, GLD |

€ 0.01 |

€ 155.82 |

Enduring Markets Swap Rates

Enduring Markets charges a fixed rate swap fee for positions held open after the end of the trading session. The fixed rate is not disclosed and is charged daily and regularly.

Enduring Markets Deposit and Withdrawal

Enduring Markets deposits are processed quickly. The specific timelines are determined by the payment services provider's schedule, which is typically one day. The broker does not charge commissions on deposits, but traders may incur fees based on the fee structure of the payment services provider.

Withdrawal requests are approved only after the client account has been verified. The standard timeline for withdrawal processing is between one to five banking days. If it takes longer than five business days, Enduring Markets updates the client via email or phone.

Deposit and Withdrawal Methods

Enduring Markets clients can deposit and withdraw funds via the following payment methods.

- Credit card

- Debit card

- Cryptocurrency transfer

- Bank transfer

Deposits and withdrawals must be made through a client-owned account.

Minimum and Maximum Deposit and Withdrawal,

The minimum initial deposit for Enduring Markets is $200. The broker doesn't mention the minimum or maximum withdrawal limits.

Enduring MarketsTradable Markets and Products

Evaluating the available tradable instruments is crucial when selecting a broker. While Enduring Markets is relatively new in the industry, it offers a good selection of trading products across the major financial markets. Here is an overview of the Enduring Markets offerings at the time of writing.

|

Asset Class |

Total |

Examples |

|

Currency pairs |

50+ |

EURUSD, CHFJPY, GBPUSD, USDCHF, AUDCAD, USDJPY, |

|

Indices |

19 |

NASDAQ, DOW, SP500, CAC40, FTSE100, DAX30 |

|

Individual stocks |

30+ |

TSLA, LYFT, FB, LMT |

|

Commodities |

17 |

Corn, wheat, sugar, soybean, rice, soybean |

|

ETFs |

12 |

LIT, SPY, QQQ, GLD |

|

Crypto |

90+ |

BTCUSD, LTCUSD, ONEUSD, LTCUSD |

|

Cannabis |

9 |

ABBV, TER, APH, SMG |

Enduring Markets Leverage Offered

The amount of leverage a client receives depends on the type of account they have. However, no specifications are provided, and the leverage is ambiguous. For instance, silver account holders have silver leverage, while gold account holders have gold leverage. There are no figures to quantify gold or silver leverage.

Leverage risk disclaimer: While leveraged forex and CFD trades increase potential profits, they also raise potential losses. It's possible to lose more than the initial capital when using leverage.

Enduring Markets Trading Platforms and Tools

Enduring Markets offers its clients a simple and user-friendly web-based trading platform. The terminal is accessible via various web browsers, for instance, Chrome, Brave, Safari, Firefox, Internet Explorer, etc. The good part is that traders don't have to install anything, while the negative part is that there is no mobile app for on-the-go trading. The web-based terminal is easy to use and contains resourceful features such as charts and market orders.

Enduring Markets Account Types

At Enduring Markets, clients can choose from seven types of live trading accounts: standard, bronze, silver, gold, platinum, pro, and VIP. The accounts offer varying features. Below is a deep dive into what each account offers.

Standard Account

- Standard leverage

- Platform presentation

- Personal account assistant

Bronze Account

- Bonus

- Bronze leverage

- 1 insured trade

- Personal financial assistant

- Beginner-level educational course

Silver Account

- Bonus

- Silver leverage

- 4 insured trades

- Personal financial assistant

- Educational course (standard level)

- Investment strategy inclusive of a financial plan

- Company financing

Gold Account

- Bonus

- Gold leverage

- 8 insured trades

- Senior financial assistant

- Educational course (advanced level)

- Investment strategy with a financial plan

- Company financing

Platinum Account

- Trading signals

- Platinum leverage

- Order notifications

- 16 risk-insured trades

- Senior financial assistant

- Premium contracts (pre-order)

- Mutual investment programs access

- Economic events & current trend updates

- Advanced investment strategy (financial plan included)

- Company financing (advanced)

Pro Account

- Premium bonus

- Pro leverage

- Premium customer care

- Personal order notifications

- Daily trading signals updates

- Exclusive programs (reservation)

- Mutual investment programs access

- Economic events & current trend updates

- Premium investment strategy (financial plan included)

- Company financing (premium)

VIP Account

The features of this account are not disclosed but the broker mentions that it's meant for a particular type of customer. The eligibility requirements are not specified, but clients can contact the broker to get more information about the account.

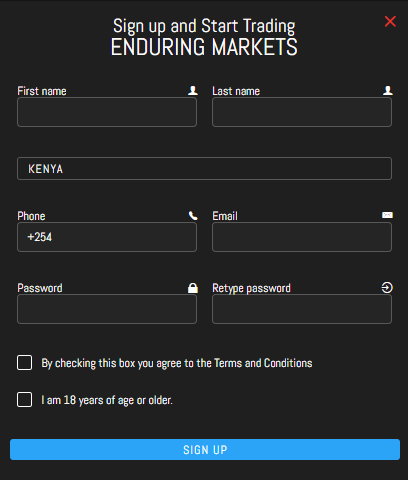

Enduring Markets Account Registration

Enduring Markets has a fully digital and fast account opening process. It only takes a few minutes. However, you must be 18 years of age or older to open an account. If you successfully open an account while you're underage, the account will be closed as soon as it is discovered. Keep in mind that a client can only open one account.

Below is the Enduring Markets sign-up process.

- Visit the official broker's website.

- Click the 'Open account' button in the top right-hand corner.

- Fill in all the fields of the registration form. (First name, last name, country, password, email, currency)

- Check the boxes for age requirements and accept the terms and conditions.

- Click the 'Sign Up' button.

Enduring Markets Customer Support

Enduring Markets provides customer support via email only. The contact email is This email address is being protected from spambots. You need JavaScript enabled to view it.. The support is offered in English only.

There are two physical locations for anyone who may need to know the broker's offices.

- 160 Victoria Street, London SW1 5LB the United Kingdom

- Marina One East Tower, 7 Straits View, Singapore 018936, Singapore

Research Tools Offered by Enduring Markets

The broker doesn't provide any free research tools on its website. However, customers who hold certain accounts (platinum, pro, VIP) have access to economic events & current trend updates.

Educational Tools Offered by Enduring Markets

Enduring Markets lags when it comes to educational tools. When writing this Enduring Markets review, the website education section only contained a glossary of 13 common CFD trading terms. There's also a section that explains more about fundamental analysis and technical analysis. And that's it. Most brokers provide free, regularly updated articles, video tutorials, client webinars, and other types of content that contain valuable information and insights.

That said, Enduring Markets offers educational courses of different levels based on the type of account. It's only the standard account that doesn't come with any type of educational course.

Enduring Markets Review Final Thoughts

Enduring Markets is a newcomer to the online brokerage industry, but it already offers a reasonable selection of tradable financial instruments. Clients interested in crypto trading may have a lot to like about the platform. The trading platform's simplicity makes it suitable for novice and experienced traders.

However, the broker needs to improve in some areas, such as information transparency. Some account features, such as premium customer service and silver leverage, may confuse traders. There are no published average trading or non-trading fees to help traders understand what to expect.

Enduring Markets FAQs

Is Enduring Markets regulated?

Enduring Markets is an unlicensed and unregulated broker.

Does Enduring Markets require account verification documents?

Yes. Once you complete the basic account registration, Enduring Markets requires you to provide the following verification documents.

- Proof of identity ( ID card/passport/driving license)

- Proof of address (utility bill or similar document not older than three months)

- Copies of credit/debit card if using cards for transactions.

Can you open an Enduring Markets account from anywhere in the world?

Yes. Enduring Markets services are available globally.

What is the minimum deposit at Enduring Markets?

The minimum deposit for Enduring Markets clients is $200, which is at par with most brokers.

Does Enduring Markets offer bonuses and promotions?

Yes, Enduring Markets provides bonuses and promotions to its clients. These offers come with conditions that must be fulfilled to withdraw the funds or profits made from trading with the bonuses. Generally, a client must reach a minimum trading volume of the bonus amount times seven in lots before the bonus expiry date to withdraw the profits.

Does Enduring Markets charge deposit and withdrawal fees?

There is no mention of deposit fees, meaning any charges while depositing are from the payment services provider. However, Enduring Markets charges an undisclosed withdrawal fee.

How long does it take to withdraw money from Enduring Markets?

Enduring Markets withdrawals take anywhere from one to five business days. If delays occur, the broker notifies the client via email or phone.

Does Enduring Markets offer negative balance protection?

The Enduring Markets website doesn't mention anything to do with negative balance protection, implying that it's not offered.

Does Enduring Markets offer a demo account?

No. Enduring Markets doesn't offer a demo trading account. Instead, traders can access seven types of live trading accounts with varying features.

What are Enduring Markets investment plans?

Enduring Markets investment plans help clients get trading skills and plan their investment moves properly to achieve their financial goals. The broker offers six types of investment plans targeting different customers.

- Trading for beginners

- Secondary income plan

- Retirement plan

- Family plan

- Holiday plan

- VIP plan

Comments powered by CComment