Definite Area Review: Is your money safe?

|

Regulation and License |

None |

|

HQ |

Unknown |

|

The founding year |

2022 |

|

Leverage range |

- |

|

Minimum deposit |

€200 |

|

Platforms |

WebTrader |

|

Tradable Instruments |

Shares, forex, commodities, indices, cryptocurrencies |

|

Demo account |

No |

|

Base Currencies |

EUR GBP USD AUD NZD CHF CAD |

|

Customer support |

Yes (English) |

|

Active clients |

- |

|

Publicly traded |

No |

|

Crypto |

Yes |

|

Website |

https://definitearea.com/ |

Pros and Cons of Definite Area

|

Pros |

Cons |

|

Doesn't co-mingle client and corporate funds |

No free educational and research materials |

|

Provides access to a wider range of tradable assets including crypto |

Holds no license from a respectable regulator |

|

Offers bonus programs |

Doesn't offer a demo account |

|

Fast account registration and verification process |

Islamic account not available |

|

Provides trading signals for certain accounts |

No company information is available |

Definite Area Quick Overview

Definite Area was launched in early 2022. Although the CFD and forex broker remain completely anonymous, it claims to have a team of financial experts who assist traders in developing personalized investment plans. The broker’s clients can trade currency pairs, cryptocurrencies, commodities, stocks, and indices.

Definite Area has developed its online trading platform to operate in the online brokerage landscape. The terminal is only accessible via web browsers. There is no mobile trading app or desktop-based terminal available.

Definite Area is not licensed or regulated. The broker's website also doesn't indicate the number of active traders. It's natural to wonder if your money is safe when trading with a new and offshore broker. However, the answer is not always obvious because traders have different risk profiles and preferences. This quick and easy Definite Area guide will highlight all the factors that can help traders determine if their money is safe with the broker.

Is Your Money Safe With Definite Area?

How do you know if your funds are secure with an online brokerage firm? Because investment is not without risk, no company, not even the best-rated broker, can guarantee 100% safety of funds. Assuming you don't make poor trading decisions, you shouldn't have to worry about losing money in your trading account. A broker's steps to secure its clients' funds and how it runs its business go a long way.

Definite Area has a policy regarding data privacy and personal data protection. The goal is to ensure customers' data, including transaction information, is securely protected from malicious third parties.

Traders may be able to recover their money if Definite Area goes bankrupt because the company keeps its clients' funds separate from corporate funds. However, there is no evidence that the company separates client funds. After all, the company is anonymous, meaning it would be difficult to trace the owners in the event that it goes under.

Because Definite Area is not licensed, there is no reputable regulatory body to hold the broker accountable. On the brighter side, there have been no reports of traders losing money when using Definite Area. However, keep in mind that no one knows how many active traders the broker has.

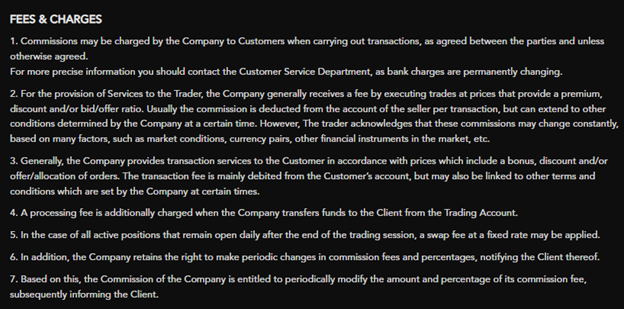

What Fees Does Definite Area Charge?

Fees can make traders feel cheated, even when they are not. That is why it is critical to understand all fees, including hidden charges, imposed by a broker.

Definite Area clients can expect to pay withdrawal commissions and account inactivity fees. These fees are called non-trading fees. The amount and rate of these fees are not specified in the broker's terms and conditions document. Notably, the broker fails to specify the specific conditions that render an account inactive, such as the duration of account inactivity.

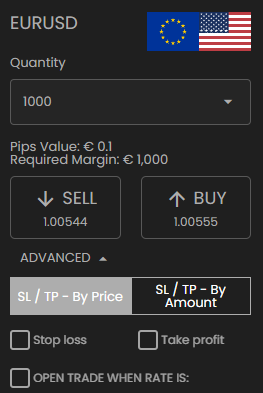

Definite Area Spread Rates

Definite Area's average spread rates are unavailable on the company's website. At the time of writing, the average spread for most assets was around 0.01pips, which was in line with the industry average.

Definite Area Swap Rates

Definite Area charges a fixed-rate swap fee for active positions that remain open after the end of a trading session. There's no clarity on what the fixed-rate amount is.

Are Definite Area Withdrawals Hassle-Free?

Clients can use prepaid cards, credit cards, and cryptocurrency to deposit and withdraw funds. The only requirement is that the payment methods bear the account holder's name. Definite Area may occasionally allow traders to withdraw funds using a different payment method than the one used to deposit funds. For example, you could deposit with a credit card and withdraw with cryptocurrency.

Withdrawals can take one to seven business days. There have been no reports of delayed or denied withdrawals, but again no one knows how many traders are using Definite Area.

Our Final Thoughts on Definite Area

Founded in early 2022, Definite Area has a long way to go in establishing trust with a loyal following if its services are legit. Due to the competitive nature of the online brokers' industry and the never-ending investment scams, a new broker can take up to ten years to build a loyal following.

Traders should exercise caution because there is no information on who is behind the company, and it is still unregulated. There is also a lack of specific information on the broker's website. For example, the broker mentions a withdrawal processing fee but does not specify how much it is.

Definite Area FAQs

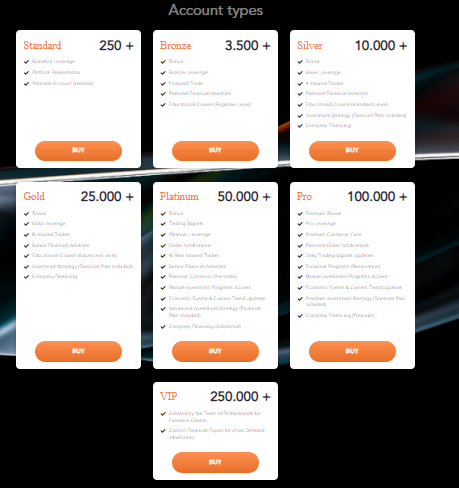

What type of accounts does Definite Area offer?

Definite Area offers seven types of live trading accounts.

- Standard

- Bronze

- Silver

- Gold

- Platinum

- Pro

- VIP

These accounts differ in terms of minimum deposits, trading signal availability, levels of customer support, bonuses, and company financing. The more features the account has, the higher the initial deposit and other features.

How can I contact Definite Area's customer support?

You can contact Definite Area's customer support team through the following methods.

- Emailing This email address is being protected from spambots. You need JavaScript enabled to view it.

- Calling +442035355844 or +3197010282402

- Launching the live chat feature from the trader's account.

The broker does not specify how long it will take to receive a response.

What assets can I trade on Definite Area?

Definite Area has good asset offerings. You can trade crypto, stocks, currencies, indices, and commodities. At the time of writing this Definite Area review, the company had the following catalog.

- 17 commodities

- 9 cannabis

- 90+ crypto

- 30+ individual stocks

- 52 currency pairs

- 19 indices

- 12 ETFs

Does Definite Area use MT4 or MT5?

No. Definite Area doesn't utilize the industry standard MT4 and MT5 trading platforms. Instead, the broker has its web-based trading platform. Traders can only use web browsers such as Brave, Chrome, Safari, Firefox, Internet Explorer, etc., to access the trading terminal. There is currently no mobile trading app available.

Can I lose more than I have in my account with Definite Area?

Definite Area doesn’t mention zero balance protection, which safeguards traders against losing more money than they have in their trading accounts. As a result, Definite Area traders run the risk of losing more money than they have in their trading accounts.

Is Definite Area a good broker?

There are no critical individual client reviews about Definite Area yet, although that doesn't necessarily make it a good broker. Certain aspects of the broker, such as anonymity and ambiguity of some information, raise concerns among potential clients.

Does Definite Area offer research and education materials?

Yes, Definite Area does provide educational and research materials to registered clients. To access the educational courses, traders must purchase one of the seven Definite Area accounts. The education section of the broker's website has limited content. There is only a glossary of commonly used words.

What is the minimum deposit for Definite Area?

The minimum deposit for Definite Area is €200. While not outrageous, some brokers offer extremely competitive rates starting at $10.

Are Definite Area spreads variable or fixed?

Definite Area spreads are variable, but there's no fee structure for the average rates. A glance at the broker's terminal reveals that most asset classes have spread rates of €0.01.

How can I sign up with Definite Area?

It is simple to sign up for Definite Area. The broker only requires the most basic information (first name, last name, email address, phone number, and country of residence.). However, traders must verify their accounts by submitting proof of address and identity documents after registering.

The steps for signing up with Definite Area are outlined below.

- Navigate to the official broker's website.

- Click 'Open account' at the top right corner or click account types and click the buy button under the account you prefer.

- Complete the application form details.

Is Definite Area a licensed broker?

No. Definite Area is not a licensed broker.

How many currency pairs are available on the Definite Area?

When writing this Definite Area review, about 52 currency pairs were available for trading.

Does Definite Area accept PayPal?

No. Definite Area doesn't accept PayPal deposits or withdrawals. Instead, Definite Area accepts crypto transfers, credit cards, debit cards, and bank wire transfers.

What is the minimum withdrawal limit at Definite Area?

Definite Area doesn't disclose the minimum withdrawal limit. Traders should be aware of an undisclosed withdrawal fee. Withdrawals take one to seven days.

Does Definite Area offer bonuses?

Yes, Definite Area offers deposits except to customers with the standard account.

Comments powered by CComment