Moonance Review: Everything You Need To Know

|

Regulation and License |

MISA |

|

HQ |

Kingstown, St. Vincent and the Grenadines |

|

The founding year |

2022 |

|

Leverage range |

Up to 1:500 |

|

Minimum deposit |

$250 |

|

Platforms |

MT4 web version, mobile apps |

|

Tradable Instruments |

Stocks, forex, CFDs, commodities, indices, metals |

|

Demo account |

Yes |

|

Base Currencies |

EUR, USD, JPY, GBP, CHF, AUD, CAD, NZD, CNY |

|

Customer support |

Yes |

|

Active clients |

100,000+ |

|

Publicly traded |

No |

|

Crypto |

No |

|

Website |

Pros and Cons of Moonance

|

Pros |

Cons |

|

Offers negative balance protection |

Charges account inactivity fees |

|

Supports social trading |

Doesn’t accept United States-based traders |

|

Provides a demo account with $10,000 virtual credit |

No Islamic account |

|

Zero deposit fees |

Has withdrawal fees |

|

Leverage of up to 1:500 |

|

Moonance Overview

Moonance.com is a CFD and forex broker established in 2022. The company is based in St. Vincent & the Grenadines, but it accepts traders from all over the world, with the exception of the United States.

From the broker’s website, Moonance is licensed and regulated by MISA. It provides traders access to over 250 tradable products in the forex, stocks, indices, commodities, and metals markets. The broker offers a seamless trading experience via the MetaTrader 4 (MT4) platform, which is available for mobile devices and the web.

Keep reading to discover all the ins and outs of trading with Moonance as analyzed by our expert traders.

Moonance Safety Review

Moonance is licensed and regulated by MISA with license number T2022122. The company also provides its registered address, First Floor, First St Vincent Bank Ltd Building, James Street, Kingstown, St. Vincent, and the Grenadines.

Moonance has a negative balance policy in place to ensure that its customers do not lose more than what is available in their trading accounts. That's a good step toward preventing traders from suffering too much loss.

Forex trading risk disclaimer: Trading CFDs is complex and involves significant risk, so it is not suitable for everyone.

Moonance Fees

Moonance doesn't charge deposit fees. But traders should expect a fixed withdrawal fee based on the amount withdrawn.

- €10 for bank wire withdrawals less than or equal to €250.

- €10 for any other withdrawals less than or equal to 20 EUR.

Inactive accounts are also subject to an inactivity fee of 10% of the account balance. The minimum and maximum inactivity fees are €25 and €49.90, respectively.

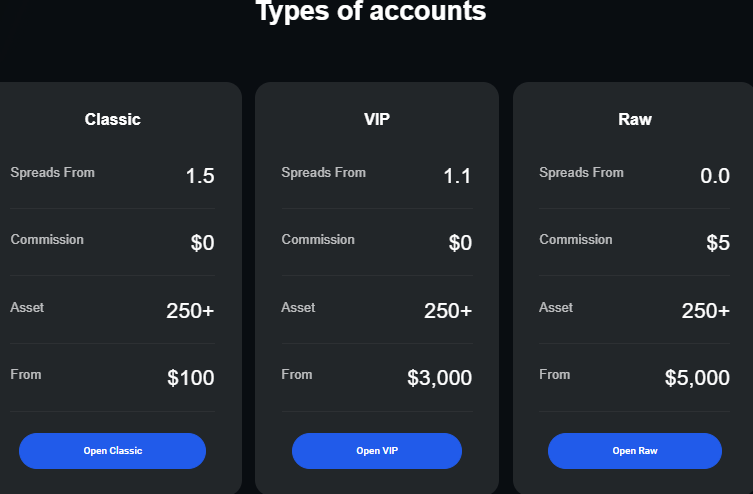

Moonance Spread Overview

Moonance spreads vary depending on the account type. The classic account spreads begin at 1.5, the VIP account spreads start at 1.1, and the Raw account spreads begin at zero. While the Raw account spreads start from zero, the account requires a commission of $5.

Unfortunately, the broker's website doesn't provide its average swap rate data.

Moonance Deposit and Withdrawal

The processing time for Moonance deposits and withdrawals is determined by the client's payment method. Deposits for most payment methods reflect on the trader's account on the same day but can take up to five days for international bank transfers.

Moonance processes withdrawals within one work day, but the funds may take up to seven business days to appear in a client's bank account.

Deposit and Withdrawal Methods

Moonance does a good job when it comes to accepted payment methods. Clients can deposit and withdraw funds using credit/debit cards, wire transfers, cryptocurrency, E-wallets, and other methods depending on their country of residence.

Minimum and Maximum Deposit and Withdrawal

Moonance has a minimum deposit of €250 but no maximum deposit. When it comes to withdrawals, Moonance doesn't have a minimum or maximum withdrawal threshold. However, withdrawal requests of less than €2 are not processed.

Moonance Tradable Markets and Products

With Moonance, you can trade forex, CFDs, indices, metals, and commodities. In general, there are over 250 tradeable assets available.

Moonance Trading Platforms and Tools

Moonance offers the industry standard MT4 trading platform, which is available in web and mobile versions (both Android and iOS). Moonance has a lot to offer anyone new to trading or interested in trying social trading. Such clients can mirror the trades of successful traders, increasing their chances of profitable trading. Traders can expect all the useful features that come with the MT4 platform, including charting tools. Moonance also offers trading signals to its clients.

Moonance Account Types

Moonance provides three types of live trading accounts. Traders can also access a demo trading account to try the broker’s platform and put their skills to the test before investing their hard-earned money.

Classic Account

- Spreads starting from 1.5

- Zero commission

- 250+ tradable assets

- Account minimum $100

VIP Account

- Spreads starting from 1.1

- Zero commission

- 250+ tradable assets

- Account minimum $3,000

Raw Account

- Spreads starting from zero

- $5 commission

- 250+ tradable assets

- Account minimum $5,000

Demo Account

Moonance provides a free demo account with $10,000 in virtual credit. Everyone who signs up for a Moonance trading account gets a demo account automatically, which is accessible from the dashboard.

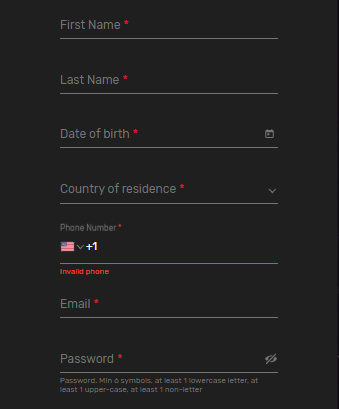

Moonance Account Registration

To open a Moonance.com trading account, you must be 18 years and have a valid mobile phone number. Moonance doesn't accept clients from the United States. If you meet those requirements, here is the registration process:

- Click the Sign-up button on the brokers' website.

- Enter the details required in the online form. (Names, phone number, email, password, country, D.O.B,

- Enter the phone number verification code sent via SMS in the appropriate field.

- Hit the "Continue" button

- Complete your details to verify your account.

- Complete the Appropriateness Test, which gauges if you understand the risks associated with trading.

Moonance Customer Support

Moonance customer support is available 24/5 from Monday to Friday (GMT+2/GMT+3. The contact information available on the broker's website is email: This email address is being protected from spambots. You need JavaScript enabled to view it..

Moonance encourages customers to contact customer service using the email addresses they used to open a trading account.

Educational Tools Offered by Moonance

No section of the broker's website is dedicated to free education and research. However, Moonance offers exclusive content to its registered clients via the dashboard. Clients can also use an economic calendar to help them make trading decisions.

Moonance Review Final Thoughts

While Moonance is a relatively new broker, its offerings are hard to overlook. These include negative balance protection, a demo account with $10,000 virtual credit, an MT4 platform, 250+ tradable assets, social trading features, and fee-free deposits.

However, the broker has some drawbacks, such as withdrawal fees, lack of an Islamic account, and no crypto trading.

Comments powered by CComment